For enterprises in Saudi Arabia, where economic diversification, Vision 2030 initiatives, and digital transformation are reshaping industries, the need for robust and agile business continuity strategies is paramount. Whether dealing with cyber threats, supply chain disruptions, or regulatory changes, companies must leverage business continuity planning services to safeguard their operations and enhance resilience.

Understanding Agile Continuity Planning

Agile continuity planning extends beyond traditional BCP by incorporating agile principles such as iterative planning, real-time monitoring, and continuous feedback loops. This approach ensures that businesses are not just reacting to crises but proactively preparing for evolving risks. Key elements include:

- Scenario-Based Planning: Rather than rigidly following a predefined plan, agile continuity strategies focus on multiple potential crisis scenarios.

- Cross-Functional Collaboration: Teams across departments work together to create adaptable strategies rather than relying on siloed planning.

- Continuous Testing & Adaptation: Regular testing and adjustments ensure continuity plans remain relevant in changing business landscapes.

- Technology Integration: Cloud computing, AI-driven risk assessment, and cybersecurity measures enhance resilience and response efficiency.

By integrating business continuity planning services, enterprises can streamline their risk management approach, ensuring alignment with regulatory frameworks, industry best practices, and emerging threats.

The Role of Agile Continuity Planning in Saudi Arabia

Saudi Arabia’s economy is rapidly transforming, driven by Vision 2030, increased foreign investments, and growing digitization across industries. However, these advancements also introduce new risks, such as:

- Cybersecurity Threats: With increased reliance on digital infrastructure, cyber-attacks pose significant risks to businesses.

- Regulatory Changes: New compliance requirements necessitate continuous adjustments to business operations.

- Supply Chain Disruptions: Geopolitical factors and global economic shifts impact supply chain reliability.

- Natural Disasters & Infrastructure Challenges: Sandstorms, extreme weather, and power outages can disrupt operations.

To address these challenges, Saudi enterprises must prioritize business continuity planning services that align with agile methodologies. A well-structured plan ensures that businesses can navigate disruptions without compromising their long-term strategic goals.

Implementing Agile Continuity Planning in Saudi Enterprises

1. Assessing Business Risks & Vulnerabilities

The first step in developing an agile continuity plan is conducting a comprehensive risk assessment. Saudi companies must evaluate:

- Operational dependencies on technology and supply chains

- Data security risks and cyber vulnerabilities

- Compliance requirements based on sector regulations

- Workforce resilience and emergency response capabilities

Risk assessments should be iterative, leveraging AI-driven analytics to predict potential threats and mitigate them proactively.

2. Developing Flexible Business Continuity Strategies

Unlike traditional rigid BCPs, agile strategies must be adaptable and scalable. Key components include:

- Modular Response Frameworks: Instead of a one-size-fits-all approach, enterprises must develop flexible response frameworks tailored to different crisis scenarios.

- Automated Incident Response Systems: Leveraging AI and machine learning for automated risk detection and mitigation ensures faster response times.

- Remote Work & Digital Collaboration Strategies: The ability to operate remotely ensures business continuity during disruptions.

3. Integrating Financial Risk Management

One of the most critical aspects of business continuity is financial resilience. Unexpected disruptions can lead to significant financial losses if companies are unprepared. By leveraging financial advisory services, businesses can:

- Establish emergency financial reserves

- Diversify revenue streams to mitigate financial shocks

- Implement cost-optimization strategies for sustainable growth

- Ensure compliance with financial regulations and reporting requirements

Saudi enterprises must integrate financial risk management into their continuity planning to maintain liquidity and long-term profitability.

4. Regular Testing & Continuous Improvement

Agile continuity planning is not a one-time process but an ongoing cycle of evaluation and enhancement. Regular testing methods include:

- Business Continuity Drills: Simulating potential crises to assess response effectiveness

- Penetration Testing & Cybersecurity Audits: Identifying and addressing IT vulnerabilities

- Supply Chain Stress Testing: Ensuring supplier reliability under different crisis conditions

Through continuous refinement and leveraging financial advisory services, businesses can improve their response mechanisms and maintain stability in uncertain environments.

The Role of Technology in Agile Business Continuity

Modern enterprises must integrate advanced technology to enhance their business continuity strategies. Key technologies include:

- Cloud Computing & Data Backup Solutions: Ensuring data security and accessibility in case of system failures.

- AI & Predictive Analytics: Identifying risks and optimizing response strategies.

- Blockchain for Secure Transactions: Enhancing financial security and reducing fraud risks.

- IoT & Smart Monitoring Systems: Enabling real-time tracking of assets, supply chains, and infrastructure resilience.

By adopting these technologies, Saudi businesses can enhance their agility and preparedness for future uncertainties.

Benefits of Agile Continuity Planning

- Enhanced Business Resilience: Faster recovery from disruptions and reduced downtime.

- Regulatory Compliance: Alignment with Saudi regulatory frameworks and global standards.

- Financial Stability: Risk mitigation strategies to protect revenue and investments.

- Competitive Advantage: Agile organizations can quickly adapt to market changes and seize new opportunities.

FAQs on Agile Continuity Planning

1. What is the difference between traditional and agile business continuity planning?

Traditional BCP relies on static, pre-defined plans, whereas agile continuity planning incorporates flexibility, iterative improvements, and real-time adaptability.

2. Why is agile continuity planning important for Saudi enterprises?

Given Saudi Arabia’s fast-paced economic transformation, regulatory shifts, and increasing digital risks, agile continuity planning ensures businesses remain resilient and competitive.

3. How do business continuity planning services support agile continuity?

They provide expert guidance, risk assessments, compliance strategies, and technology solutions to enhance resilience and crisis response capabilities.

4. What role do financial advisory services play in business continuity?

They help businesses manage financial risks, optimize cash flow, and maintain stability during disruptions.

5. How can small businesses in Saudi Arabia implement agile continuity planning?

By leveraging cloud-based BCP solutions, outsourcing risk management expertise, and conducting regular crisis simulations, even small businesses can adopt agile strategies.

Agile continuity planning is essential for modern enterprises operating in dynamic and unpredictable business environments. For Saudi businesses, integrating business continuity planning services and leveraging financial advisory services ensures resilience, regulatory compliance, and long-term success. By adopting a proactive, technology-driven approach, companies can navigate disruptions efficiently and sustain growth in the evolving economic landscape of Saudi Arabia.

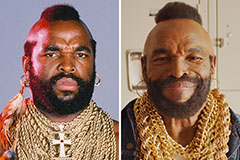

Mr. T Then & Now!

Mr. T Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!